vanguard intermediate term tax exempt bond index fund

The Vanguard Intermediate Term Bond Index Fund is usually considered a candidate for placement in tax advantaged accountsThe fund is often recommended see Fig. Get up to 24 months of prices for this fund.

Vanguard Total Bond Market Index Fund Tax Distributions Bogleheads

Vanguard Intermediate-Term Tax-Exempt FundAdmiral historical charts and prices financials and todays real-time VWIUX stock price.

. See Vanguard Tax-Exempt Bond Fund performance holdings fees risk and other data from Morningstar SP and others. 1 as a core. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

2012 is exempt from Indiana income tax. If you own a fund that includes foreign investments the fund may have paid foreign taxes on the income which is passed to you as a. USAA Tax Exempt Intermediate Term Fund USATX 3.

He has worked in investment management since 1996 has managed investment portfolios since. For mutual funds Indiana. Vanguard funds that are eligible for the foreign tax credit.

This mutual fund profile of the CA IT Tax-Exempt Admiral provides details such as the fund objective average annual total returns after-tax returns initial minimum investment expense. Write checks for 250 or more from your Vanguard nonretirement. The fund invests primarily in high-quality municipal bonds issued by California state and local governments as well as by regional governmental and public financing.

Vanguard mutual funds Vanguard ETFs Vanguard 529 portfolios. DArcy CFA Portfolio Manager at Vanguard. You can also export all prices of this fund since the inception date.

Bond funds and Vanguard Tax-Managed Balanced Fund. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. California Intermediate-Term Tax-Exempt Fund 100.

Simplify your finances with any of the following optional services for this fund. Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax-exempt municipal bonds at an attractive price earning a Morningstar Analyst Rating of Gold. To see the profile for a specific Vanguard mutual fund ETF or 529 portfolio browse a list of all.

Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own.

The Best Performing Bond Etfs How To Find Them Nasdaq

What S Inside The Vanguard Total Bond Index Fund My Money Blog

5 Vanguard Bond Etfs Boasting Substantial Ytd Inflows

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

/stock_9-5bfc2b85c9e77c00517fd0f7.jpg)

3 Top Vanguard Fixed Income Funds

A Taxable Account Isn T Actually That Bad Live Free Md

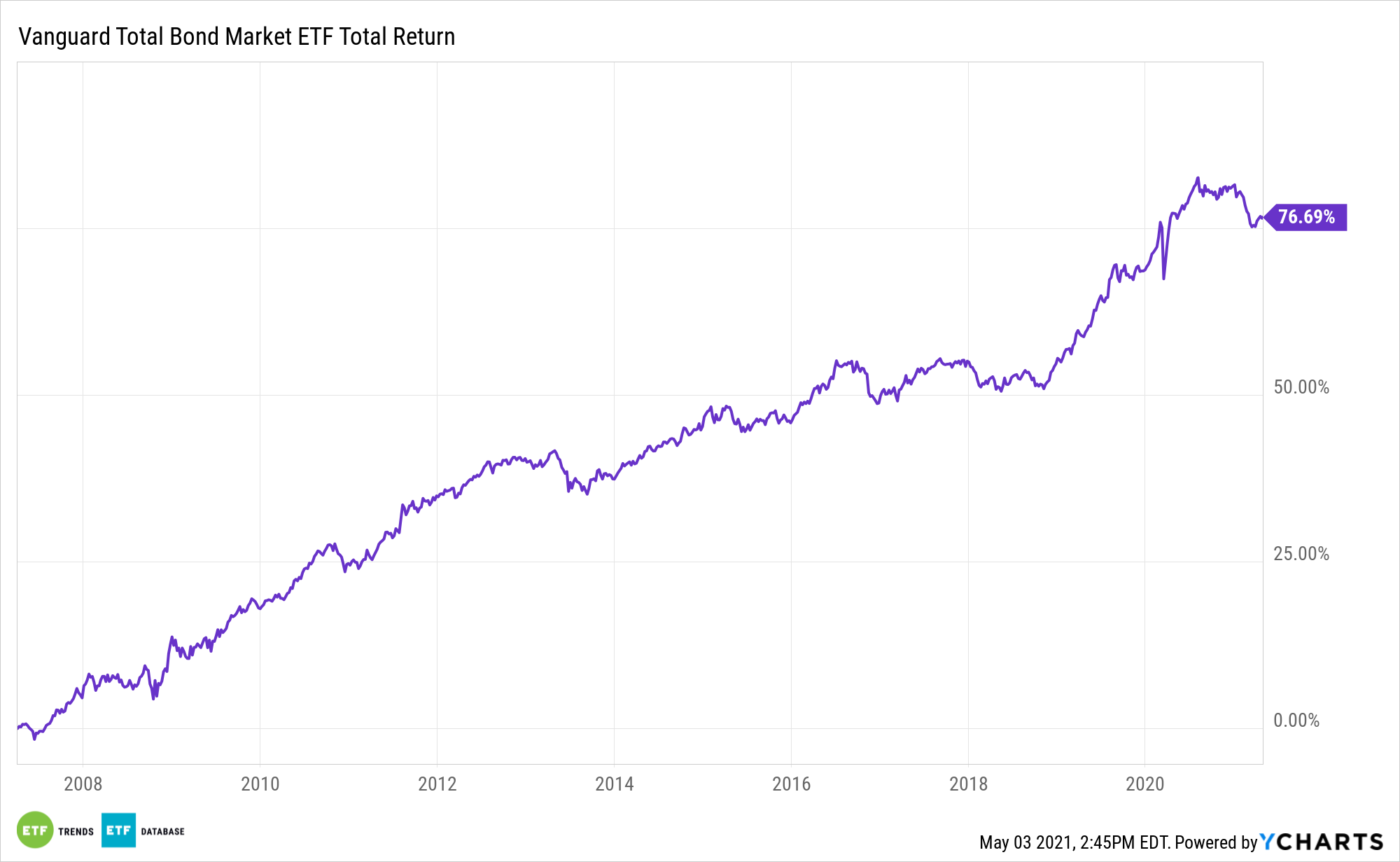

The Best Bond Etfs A Complete Guide Ycharts

Tax Loss Harvesting Vanguard Intermediate Term Tax Exempt Fund Bogleheads Org

7 Vanguard Funds For Conservative Investors Vteb Vym Vtc Investorplace

Vanguard Tax Exempt Bond Funds Nasdaq

Vanguard 500 Index Fund Tax Distributions Bogleheads

7 Best Bond Index Funds To Buy

Vwiux Vanguard Product Detail Intermediate Term Tax Exempt Fund Admiral Shares

The Best Performing Bond Etfs How To Find Them Nasdaq